The USA crowdfunding market is ranked first regionally and second globally, mainly thanks to adequate, up-to-date regulation provided by the SEC. According to the Cambridge report, over 70% of players consider the current legislative framework appropriate for their investment platform activities.

And it’s an excellent indicator compared to other countries.

The SEC keeps simplifying and harmonizing the rules to benefit every party – platforms, fundraisers, and investors.

For instance, on November 2, 2020, the body introduced rule amendments to Reg A, Reg D, and Reg FC offerings.

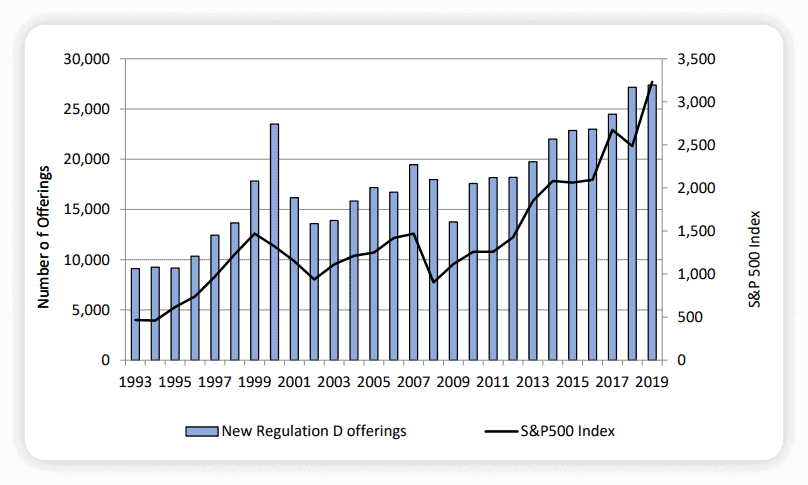

Source: SEC, Number of Reg D offerings

These changes are to make guidelines more rational and less complex.

Reg A and Reg D: how the SEC regulates exempt offerings

US and non-US-based companies can offer and sell securities under Reg A and Reg D. Both rules are exemptions of the “Securities Act.”

Reg D offerings have always been more popular among fundraisers.

The SEC reports a steady growth of Reg D offerings in recent years. This model accounts for a more extensive offering market share.

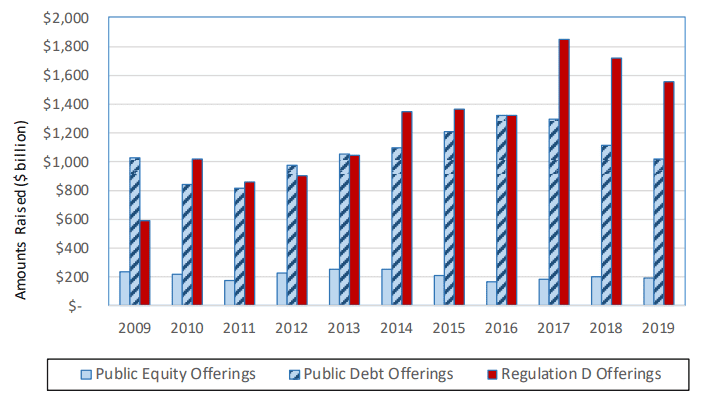

For example, in 2019, under Reg A, only $1 billion was raised, while Reg D offerings amounted to +$1.5 trillion.

What should you know about exempt securities offerings regulation?

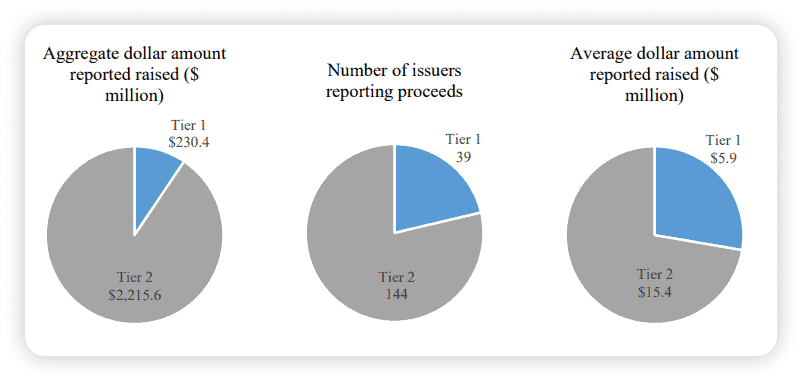

Reg A (Reg A+) consists of two tiers (Tier 1 and Tier 2), allowing companies to conduct “Mini-IPOs” distinguished by the upper limit of offerings:

Reg A Tier 1 enables businesses to collect up to $20 million in 12 months;

Reg A Tier 2 – up to $75 million in 12 months.

At rest, companies may comply with standards established for this type of offering – issuer, investor, and SEC filing requirements, disclosure, resale restrictions, etc.

Due to new rules, general solicitation for Reg A will soon be replaced with “Demo Days” and similar events.

70% of all Reg A-based offerings are registered under Tier 2.

Source: Source: Capital raised under Reg A

The SEC has analyzed all issuers in qualified Regulation A offerings and concluded that most are small (based on assets and revenues) and relatively young.

93% of offerings were equity-based, and 80% were conducted continuously.

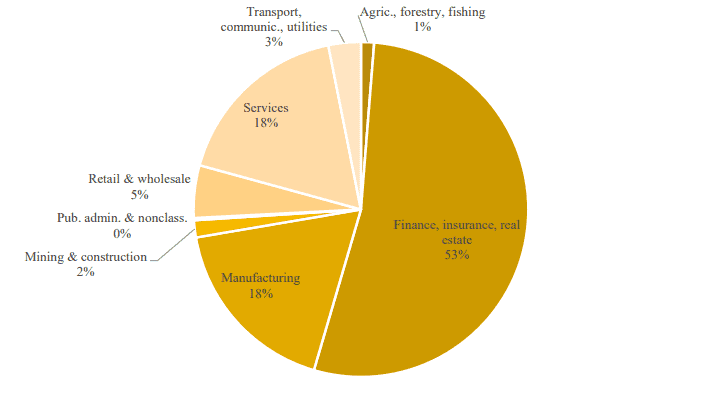

The most significant part of offerings (53%) is concentrated in the finance, insurance, and real estate sectors.

REITs, holding companies, non-depository credit institutions, and commercial banks often act as financial issuers.

As for non-financial issuers, most players provide business services, including software.

Source: Capital distribution in Reg A offerings by issuer industry

An estimated timeline for Reg A crowdfunding offerings: 2-4 months, max allowed time – 12 months.

Some examples of the Reg A portals are:

SeedInvest WeFunder Banq

Now let’s talk about Regulation D or accredited crowdfunding.

The exemptions were adopted in 1982 to simplify rules and strengthen investor protection.

Initially, Reg D included three rules: Rule 504, Rule 505, and Rule 506. In 2017 Rule 505 was abolished. The current Reg D framework consists of Rule 504, Rule 506 (b), and 506 (c).

How do the Reg D rules differ from Reg A?

Rule 504 is for securities offers and sales of up to $10 million in a 12-month period. Reporting companies, investment companies, and certain development-stage companies can’t issue securities under Rule 504. Also, issuers may not use general solicitation or advertising to market the securities.

Rule 506 (b) is a “non-exclusive safe harbor” enabling issuers to offer and sell unlimited securities.

There are some conditions for issuers to meet: offers don’t imply general solicitation or advertising. Only accredited investors take part in deals

the max number of non-accredited investors – 35

Rule 506 (c) is more loyal to issuers: no limitation on amounts offered, and general solicitation and advertising are allowed only if backers are accredited.

Reg D offerings market statistics:

in 2019, out of all the Reg D offering types, almost all the capital was raised under Rule 506 (b), nearly 40% of Reg D issuers are private funds, real estate – 25.5%, tech – 20%, most Reg D issuers are located in California or New York

9% of all issuers are non-US-based

most issuers tend to be small-scale, with revenue of less than $1 million

the majority of non-fund issuers raise funds through equity

Reg D offerings are way more popular than public equity or debt offerings.

Source: Capital raised through different models of offerings

An estimated timeline for Reg D offerings: 100 days. Some examples of the Reg D portals are:

FundersClub AngelList CircleUp

Title III of the JOBS Act and retail crowdfunding

Reg CF crowdfunding defines the requirements for offering and selling securities under Section 4(a)(6) added by Title III of the JOBS Act to the Securities Act.

Despite COVID-19, during 2019-2020, capital commitments to Reg CF issuers rose by 77.6%. The number of investors increased too.

Experts believe it happened due to several factors, including industry development, investor education, and regulatory changes.

Characteristics of the Reg CF:

The maximum aggregate amount of funds to raise – is $5 million in a 12-monthly period. All deals should take place on a registered provider – broker-dealer or Reg CF funding portal

investment limitations based on an annual income and net worth; bad actors’ disqualification

disclosure of information in filings is required

According to new rules which came into effect in March, the offering limit was increased to $5 million, and investment limits for accredited investors have been removed. Also, the SEC extended the existing temporary relief providing an exemption of up to 18 months for issuers offering $250k or less of securities and allowing the latter to use SPVs to facilitate investing.

The general solicitation will be replaced with “testing the waters.” Characteristics of crowdfunding issuers and offerings:

in 2019, most offerings (90%) were conducted through Reg CF funding portals;

a typical fundraiser is small and early-stage, with $30k of assets, $4k

holdings and no revenue;

average amount raised per offering in 2020: $342k;

equity deals prevail over debt and SAFE; their share accounts for 48%; the top industries: restaurants, diversified media, personal services, etc.

the majority of offerings are made in California, followed by New York and Texas;

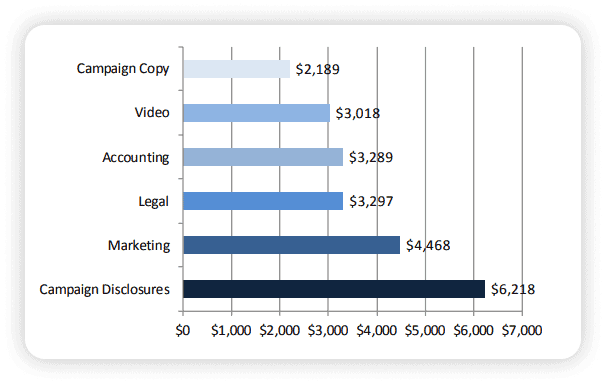

an average cost of a crowdfunding campaign is 5.3% of the amount raised;

a median timeline for a crowdfunding campaign under Reg CF – 60-90 days.

Source: The average breakdown of costs (in dollars) per activity

Some examples of the Reg CF portals are:

SeedInvest InfraShares FlashFunders Republic WeFunder

Comparing Reg CF vs Reg A and Reg D crowdfunding offerings

There are many summary tables on US regulatory frameworks for securities offerings online, so we decided to keep this information distinct.

Instead, we’ll summarize how offerings differ by their characteristics. Note all the numbers are rough estimations of the available data presented in the official reports and open data banks.

| Characteristics | Reg A | Reg D | Reg CF |

| Typical issuer | small and relatively young | small-scale with revenue less than $1m | small and early-stage |

| Mean offer size | $26m | $58m | $208k |

| Top Industries | finance, manufacturing, services | private funds, real estate, tech, health care, banking | restaurants, diversified media, personal services |

| Average offering timeline | 2-4 months | 3-4 months | 2-3 months |

| Average offering cost | 12% of the capital raised | 10% to 12% of capital raised | 5.3% of the amount raised |

Final thoughts

Regulation is a crucial factor in the finance industry’s success. Over the past decade, regulatory requirements in the US have evolved to keep pace with a rapidly developing complex alternative financing market.

As crowdfunding providers strive to keep pace with ever-changing regulations, they’re turning to intelligent solutions to address this issue.

Please note that this article is for informational purposes only, don’t consider it legal advice or recommendation. Speak with your lawyer and consult only official resources regarding any up-to-date information on the regulations and policies.